san antonio tax rate calculator

Ad Automate Standardize Taxability on Sales and Purchase Transactions. Sales Tax calculator San Antonio Fill in price either with or without sales tax.

Texas Income Tax Calculator Smartasset

Property Tax in San Antonio TX 2022 Guide Rates Due Date Exemptions Calculator Records Codes Ultimate San Antonio Real Property Tax Guide for 2022 Home Texas Bexar County San Antonio Guide Overview Average Rates Tax Reduction Due Date How Tax Works Tax and Closing Guide Overview.

. If your normal tax rate is higher than 22 you might want to ask your employer to identify your supplemental. In addition to. 78201 78202 78203.

San Antonio TX 78205. The December 2020 total local sales tax rate was also 8250. 77 rows Property Tax Rate Calculation Worksheets Senate Bill 2 SB2 of the 86 th Texas Legislature requires the Tax Assessor-Collector from each county to post their website the worksheets used to calculate the No-New-Revenue and Voter-Approval tax rates for the most recent five 5 years.

Box 839975 San Antonio Texas 78283-3975. In-Person Delivery Please direct these items to the new City Tower location City of San Antonio Print Mail Center. The sales tax rate for San Antonio was updated for the 2020 tax year this is the current sales tax rate we are using in the San Antonio Texas Sales Tax Comparison Calculator for 202223.

San Antonio TX Sales Tax Rate The current total local sales tax rate in San Antonio TX is 8250. Sales Tax Breakdown San Antonio Details San Antonio TX is in Bexar County. For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations.

Skip to main content Sales877-780-4848 Support Sign in Solutions Products Resources Partners About Blog Calculate rates. Jurors parking at the garage will receive a discounted rate please bring your parking ticket for validation at Jury Services. Discover Helpful Information And Resources On Taxes From AARP.

San Antonio Sales Tax Rates for 2022 San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. There is no applicable county tax. San Antonio is in the following zip codes.

You can find more tax rates and allowances for. The tax rate varies from year to year depending on the countys needs. The results are rounded to two decimals.

Enter an amount into the calculator above to find out how what kind of sales tax youll see in San Antonio Texas. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. SmartAssets Texas paycheck calculator shows your hourly and salary income after federal state and local taxes.

A delinquent tax incurs interest at the rate of 1 for the first month and an additional 1 for each month the tax remains delinquent. Youll then get results that can help provide you a better idea of what to expect. 211 South Flores Street San Antonio TX 78207 Phone.

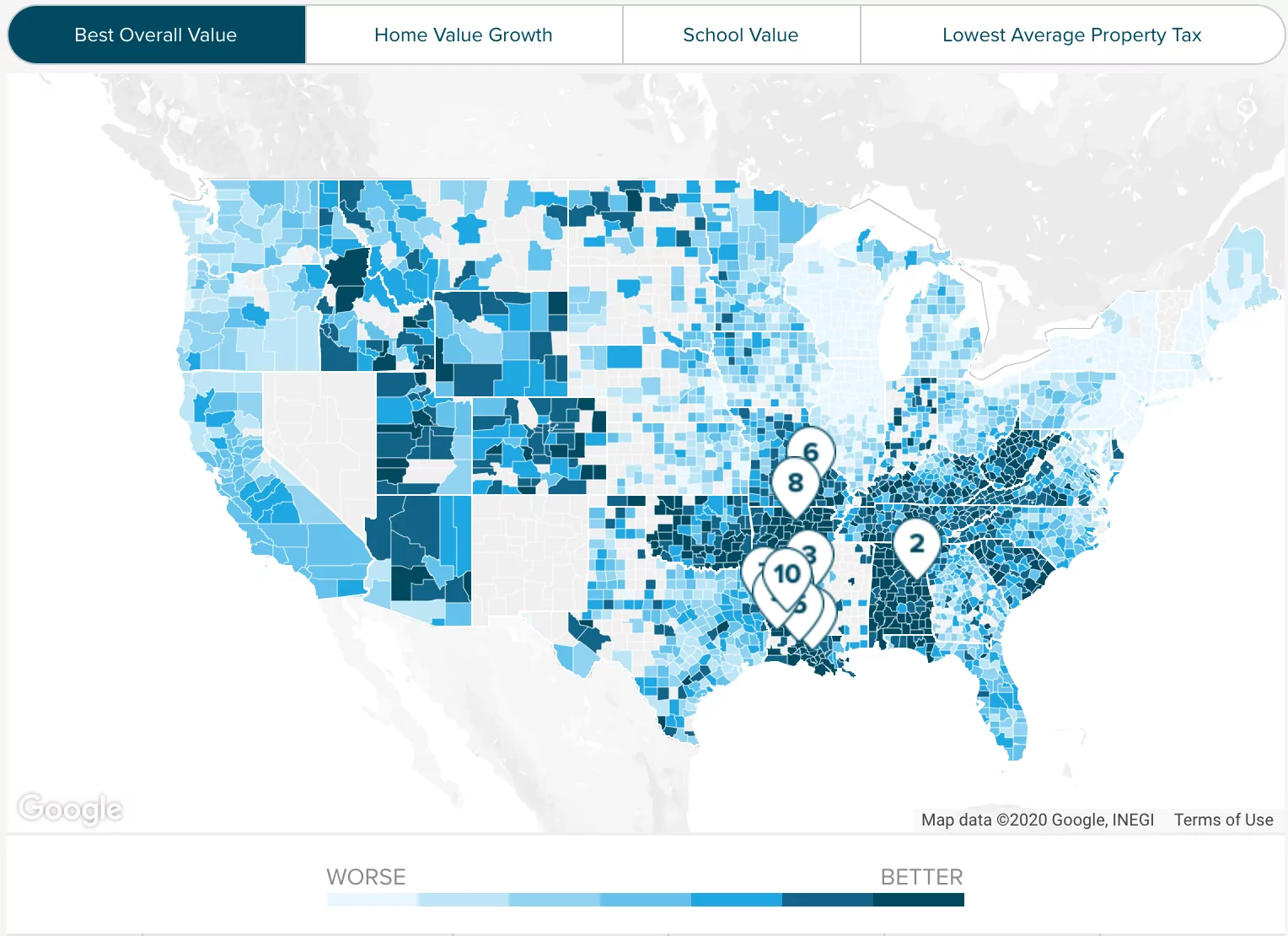

How Does Sales Tax in San Antonio Mta compare to the rest of Texas. This is the total of state county and city sales tax rates. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address.

Texas Property Tax Rates. Avalara provides supported pre-built integration. The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value.

Sales tax in San Antonio Texas is currently 825. Look up 2022 sales tax rates for San Antonio Texas and surrounding areas. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage.

A copy of the complete hotel bill must be included with refund claim. Property Tax Rate Calculation Worksheets by Jurisdiction. The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division.

Property taxes for debt repayment are set at 21150 cents per 100 of taxable value. Tax rates are provided by Avalara and updated monthly. For comparison the median home value in.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Tax statements are then sent to all property owners. Taxes become delinquent if not paid by the due date.

They can either be taxed at your regular rate or at a flat rate of 22. Rates will vary and will be posted upon arrival. Tax info is updated from httpscomptrollertexasgovtaxessalescityphp and dated April 1 2022.

San Antonio Mta in Texas has a tax rate of 675 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio Mta totaling 05. San Antonio collects the maximum legal local sales tax The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. You can find more tax rates and allowances for San Antonio Mta and Texas in the 2022 Texas Tax Tables.

Please note that we can only estimate your property tax based on median property taxes in your area. 822 Average Sales Tax Summary The average cumulative sales. A refund may be applied where allowable by forwarding a properly documented and completed City of San Antonio Claim for Refund of City Hotel Occupancy Tax form to the City of San Antonio Revenue Collections Division PO.

Tax rates are provided by Avalara and updated monthly. The property tax rate for the City of San Antonio consists of two components. Enter your info to see your take home pay.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Integrate Vertex seamlessly to the systems you already use. You can find more tax rates and allowances for San Antonio and Texas in the 2022 Texas Tax Tables.

5 Tips For First Time Home Buyers Infographic First Time Home Buyers Arizona Real Estate Real Estate Humor

Tarrant County Tx Property Tax Calculator Smartasset

What To Do If Your Tax Return Is Flagged By The Irs

Ask These 5 Questions Before Hiring A Real Estate Agent Rental Property Home Buying Rent To Own Homes

Cost Segregation Study Tax Reduction Income Tax Income

Is It Better To Rent Or Buy Published 2018 Mortgage Amortization Calculator Mortgage Loan Originator Mortgage Loan Calculator

Texas Income Tax Calculator Smartasset

Understanding Tax Rate Discrepancies

Understanding Tax Rate Discrepancies

Property Tax Calculator Casaplorer

Homeownership Is A Key To Building Wealth Wealth Building Home Ownership Wealth

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Understanding California S Sales Tax

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Understanding California S Sales Tax

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption